Search This Blog

Generate passive income. Invest for the long term. A lifestyle and passive income blog by Mr. IPO

Posts

Showing posts from June, 2013

Starfish SRS Portfolio Expected Yield

- Get link

- Other Apps

A Global Meltdown and a REITgrettable mistake?

- Get link

- Other Apps

Mapletree Commercial Trust & Sabana REIT

- Get link

- Other Apps

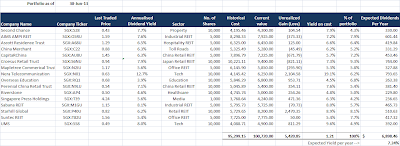

Starfish SRS Portfolio as of 31 May 2013

- Get link

- Other Apps