Search This Blog

Generate passive income. Invest for the long term. A lifestyle and passive income blog by Mr. IPO

Posts

Showing posts from 2014

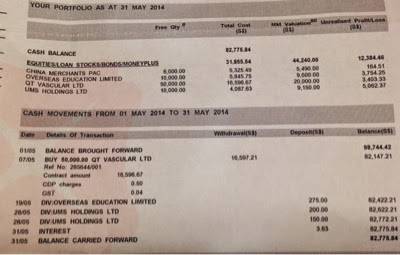

360 review - Pre IPO investments

- Get link

- Other Apps

What does KFC has to do with Mr. IPO?

- Get link

- Other Apps