Cash back or Air miles ?

I received the online CPF statement in my inbox this week - the yearly statement with colourful charts and breakdown. I blogged about my CPF balance in 2017 here.

CPF is one of the tools which you should use for your own retirement needs. It is almost "risk-free", hence you should "hack" it to the max.

I am extremely pleased to see the balances in the OA, SA and MA accounts increasing nicely 🤩 and i am pretty sure it will hit $1m by the time i retire. You can and should use it for your retirement planning too. So how did my CPF "performed"?

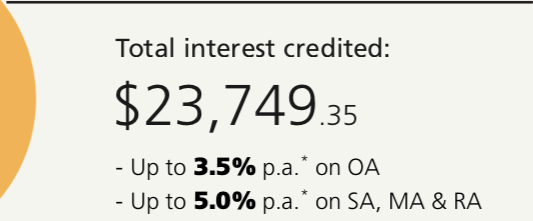

I received $23,749 as interest income in 2018 and spent $1,004.

As you can see, other than for the medical premiums, I did not use it for my housing. Currently, the all-in costs for my housing loan is below 2.5% and i pay for them in cash.

Cash back or Miles ?

So today's subject header is Cash Back or Miles? (Is this even worth debating?)

There are basically two camps. Cash back camp advocates that one should get cash back from credit card 💳 spending whereas the Miles camp advocates the same spending be "converted" into frequent flier miles for redemption into air tickets. ✈️

I hold a few credit cards in my wallet and they are all credit cards that maximises the returns for Krisflyer miles. In case you really need to know, below are the 3 cards that are in my wallet all the time - Citibank Premier Miles, DBS Altitude Card Visa, and UOB Privi Miles Amex.

What is the cash back conversion rate?

Visa and Mastercard typically charges 2% of transaction value to the merchants and Amex is likely at the higher end of 3%. They have to share with the banks that provide the cards.

As such the "max" which the banks can rebate is probably capped at 1.5%. Thus assuming you spent $150,000 on the credit card, you will receive $2,250 cash back.

What is the Air Miles conversion rate ?

Using the same example as above and the minimum rate (not counting the extra miles you get on overseas or certain expenditure), you will get 210,000 air miles if you spend $150,000.

What stage of your life are you at and what type of job you hold ?

This is where I find the "debate" as to whether cashback or miles is better is really meaningless. Why?

Cos the answer is it really depends on what stage of your life are you at, the career path and consequently your frequent flier status!

Stage of life

If you are just starting out in life (18-30), you are probably still a junior person at work. Salary is probably enough to cover basic expenses but luxury splurges will be more measured. This is a time where you want to have extra cash and the cash back option may be more appealing.

As you progressed in life, where your pay starts to get more comfortable, your goals in life changes. When you are between 30-45, probably started a family, money is still important but no longer the most important. You will probably want to spend more time with your loved ones, travel round the world to enjoy life 🏖. At this stage of your life, probably air miles likely will become more "valuable" than cash.

Career role and frequent flyer status

I was in the "cashback" camp until I changed job in 2010, where my role changed thereafter. I started to travel frequently and consequently, my Krisflyer status "accelerated". You can read about my PPS status here.

The PPS status combined with credit card miles made it much easier to redeem flights for my family. That resulted me to move from the cash back camp to the air miles camp in 2012!

What is the "real value" of credit card miles to me now?

I will opt for air miles day in and out. Let me give you a simple illustration using the above example. As I travel frequently, combining the travel miles I earn on the trip with the credit card miles now makes a lot of sense. Even then, just considering the credit miles alone, what is true value ?

Case study

Here is a real life example - I am trying to redeem a flight for my family of 4 during the March holidays. A quick check using the Skyscanner or Krisflyer app will show that the cost of flying during this period is $5,849.20.

If I can redeem the tickets (economy saver for 4), what would be the value ?

It will cost me $367 and 200,000 miles.

So the value for the 200,000 miles in this case is $5,849 less $367 = $5,482.

In cash back terms, 200,000 miles is equivalent to $2,142 (200k miles divide by 1.4 x 1.5%).

As such the value of air miles outweigh the cash back by $5,482 less $2,142 =$2,660.

My personal view

My own view is that if you want the best "value" for your air miles, you should not redeem economy saver tickets on Krisflyer. You will get the best value if you are able to redeem business class saver tickets.

Conclusion

Don't be so engrossed into whether cash back or air miles. It really depends on what you want in life and at what stage of the life cycle you are in. So at this stage of my life, it is air miles hands down but that might change again later in life when I turn 70! So don't be too hung up on it.

One website that you may want to read more about hacking the air miles is the Mileslion website.

Happy Air Milesing...

One website that you may want to read more about hacking the air miles is the Mileslion website.

Happy Air Milesing...

Very interesting post. Thanks for sharing info on cash back or air miles.

ReplyDelete