Using CPF for retirement

The Sunday Times ran a two-part series on CPF last Sunday and today. It's definitely worth spending some time to read through those articles and ponder on them regardless of your age. 😄

This will allow you to make informed decisions on CPF and whether you want to take "irreversible" actions when you are younger, such as topping up your CPF or transferring cash from OA to SA. (I didn't do any of the above when I am young, as I was not "well informed" or didn't bother to. 😆)

CPF should form part of your retirement planning and help enhances your life after you retire. Since each one of us has different plans and uses and are at different stages of lives, I will touch on areas that affect me more.

Setting aside the retirement sum in exchange for a lifelong "passive income"

When I turn 55 (based on current rules), I have to set aside the prevailing Full Retirement Sum of $166,000. I can start "withdrawing" monthly payout of between $1,270 and $1,410 for life from aged 65 till my demise.

If I want more monthly payout, then I can set aside more cash, up till the Enhanced Retirement Sum of $249,000 for a monthly payout of between $1,850 to $2,050.

🖐🏻 (I haven't yet to find out what happens to the "cash" if I die early 英年早逝. This will be quite important in my decision in selecting the different plans!) 🤔

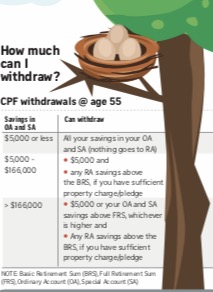

How much can I withdraw from CPF at age 55?

You don't have to protest at Hong Lim park really. You will be able to withdraw part of your CPF at aged 55 or anytime thereafter if you choose to keep the cash in the Retirement Account.

For simplicity, you can withdraw the higher of $5,000 or amount in excess of $166,000.

👉🏻 Implication: If you already have combined OA and SA balances above $166,000, you can treat CPF as a long-term fixed deposit bank (provided the rules or FRS amount don't change 😂).

Example - if i already have the FRS and I have withdrawn $50,000 from CPF to pay for my monthly mortgages, I can consider "repaying" CPF the $50,000 from my savings and year end bonuses. This will allow me to get that $50,000 back when I am 55 and allow me to earn 2.5% p.a. In addition, I don't have to pay myself "interest" back to CPF on that amount drawn!

Example - if I have sufficient cash or passive income to cover for my daily expenses, I can consider keeping those cash in the Retirement Account. After I turn 55, the first $30,000 earns 6%. See graphics below on the interest earned.

How much interest does balances in CPF earns?

Interest in CPF balances earns "risk-free" returns of between 2.5% to 6% depending on your age group.

Topping up CPF accounts

As you can see from the graphics above, there are a few things which you can do for retirement to earn a higher interest rate.

Example - you can top up your own Special Account with cash each year or you can transfer cash from OA to SA. This earns you 4% interest instead of 2.5% each year. Over the long run of more than 10 years, the compounding effect of that extra 1.5% can become very material!

Example - I top up $3,500 cash each to the Retirement Accounts of my parents every year. I get a tax deduction and they earn a higher interest and get a monthly payout ($3,500 divide by 12) ! Win-win situation 😂

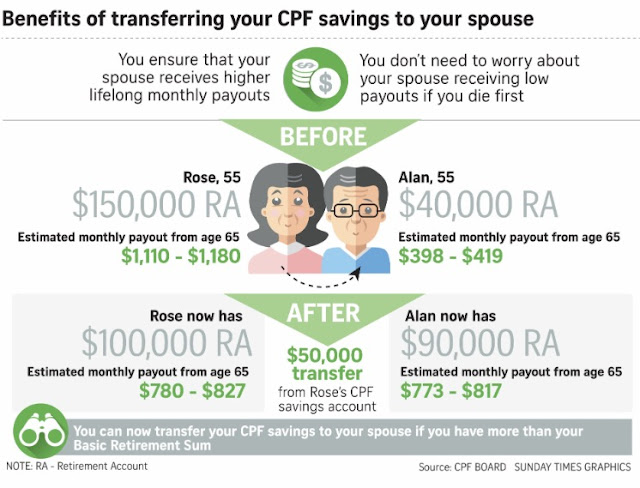

Example - if your spouse isn't working, you can also consider transferring your CPF savings to him or her. This will ensure both have higher "life-long" passive income! I always believe that retirement planning is not just for you alone, but for all your loved ones.

Example - during CNY, instead of putting red packets of your kids into meager earning bank account, you can consider depositing the cash into their special accounts. A $500 contribution when your child is 5 years old can turn into $3,553 after 50 years at 4%! Meaning a $50,000 will turn into $355,300. I will probably start depositing their Ang Pow money into their special accounts from this year onwards.

Medical expenses

Medisave account balance will remain to pay for future healthcare expenses. The current Basic Healthcare Sum we need to set aside is $52,000.

The Sunday Times provided the graphics for using your medisave.

That's it for today. Happy CPF planning.

Payouts from CPF LIFE is one of the taps for retirement funds. It cannot be viewed as the ONLY tap

ReplyDeleteYou are absolutely right!

Deletekids (say below 18) have CPF/SA account? I didn't know that

ReplyDeleteThat is what I understand to be.. let me know if you find out otherwise ! 😆

DeleteSome additional stuff:-

ReplyDelete1. You can check CPF website to have some idea of how much refund if you pass away before fully using up your CPF Life. Not comprehensively presented though. And the figures have changed every couple of years due to internal actuarial insurance figures changing over the years. Not enough transparency here.

2. Currently 2 types of CPF Life: Standard & Basic.

Soon will have a 3rd type: Inflation-linked.

You don't have to select at 55, can wait until 65. In the meantime let it compound at 4% to 6% in your RA.

You can also use the CPF website to show you the different CPF Life payouts, and if you select at 55 vs 65.

3. The FRS will be increased at 3% per annum every 1 Jan. Now is $166K. In 1 Jan 2018 it will be $171K (round up to nearest thousand dollars).

4. The BHS (Medisave) is currently $52K. It will be increased every 1 Jan by average healthcare inflation. This one is scary becoz Singapore is experiencing healthcare hyperinflation.

5. You can open CPF account for your baby the moment you have registered it & obtained NRIC.

6. If you have spare cash you can dump it straight into your baby's SA account as a form of long-term trust fund. Instead of your baby getting hold of the money at 25 or 30 yrs old, he gets it only when he turns 55.

7. If you are cash-rich, you can dump the full FRS into baby's SA account. As the increase in FRS is only 3% p.a. and the interest is at least 4% p.a., hence by putting in the full FRS, it becomes self-sustaining as the annual interest is more than enough to cover the annual increase in FRS. Imagine $166K turning into more than $1.5M when baby becomes old man at 55, haha.

Thanks for the comprehensive comments ! Very helpful! 😊 I will look into them.

DeleteOh I forgot 2 more things, but you should be familiar with them:-

Delete8. Can do voluntary top-up to your CPF up to the annual limit (currently $37,740). The annual limit is inclusive of the usual employee/employer contribution. But no tax deductible for this voluntary top-up.

9. Can do top-up to your SA/RA accounts, up to the specified FRS(<55) or ERS(>=55). However only the first $7,000 within FRS amount is counted for tax deductible. Hence most working people will only top up $7K each year to their SA/RA if they haven't hit the FRS yet.

*** IRAS has just put in limit of $80K for personal tax relief, so if you already got other hefty tax deductibles, you should sum up all your reliefs carefully to see if it's worthwhile to top-up your SA/RA just for tax deductible purpose.