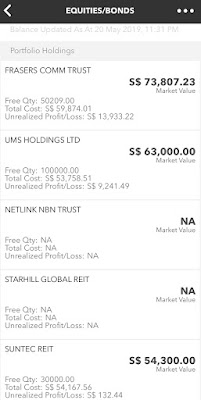

SRS Portfolio Update - May 2019

This will be a quick update on the transactions.

Since my last post, I added a new position in my SRS Portfolio - 30,000 of Suntec REIT at $1.80 last week.

Suntec REIT has been sold down in recent week due to a placement exercise and at $1.80, it is trading below its book value and the yield is around 5.5%.

The 30,000 shares will add around $3,000 in passive income annually.

However, for the non SRS portfolio, I sold off my position in Keppel KBS REIT at 73 to raise USD for some USD bonds that I am thinking of acquiring in the coming weeks.

As such, the contribution from Suntec was more than offset by the loss of income due to sale of Keppel KBS US Reit. The projected passive income dropped slightly to $80,731. The drop is temporal and will pick up again once the bonds are acquired.

That's all the update for now. The remaining cash in SRS stands at $53,742 as of today.

Since my last post, I added a new position in my SRS Portfolio - 30,000 of Suntec REIT at $1.80 last week.

Suntec REIT has been sold down in recent week due to a placement exercise and at $1.80, it is trading below its book value and the yield is around 5.5%.

The 30,000 shares will add around $3,000 in passive income annually.

However, for the non SRS portfolio, I sold off my position in Keppel KBS REIT at 73 to raise USD for some USD bonds that I am thinking of acquiring in the coming weeks.

As such, the contribution from Suntec was more than offset by the loss of income due to sale of Keppel KBS US Reit. The projected passive income dropped slightly to $80,731. The drop is temporal and will pick up again once the bonds are acquired.

That's all the update for now. The remaining cash in SRS stands at $53,742 as of today.

Comments

Post a Comment