SRS Portfolio - 31 Aug 2019

Bond portfolio - finally some "luck" ?

Following up on my post last week, I wasn't successful on SPH REIT perps. Reason given was that my application amount was "too low" 😤.

I decided to "blow up" my application to $2m when UBS SGD AT1 perps was released. You can read about the bond by Fundsupermart here. The final interest rate for the 5Y non call perps was priced at 4.8% and I was finally allotted $250,000.

I haven't decided if I should fund this purchase with more debt or with cash. If it is debt, whether to fund it in SGD (2.41%) or other currencies like EUR or JPY (0.75%).

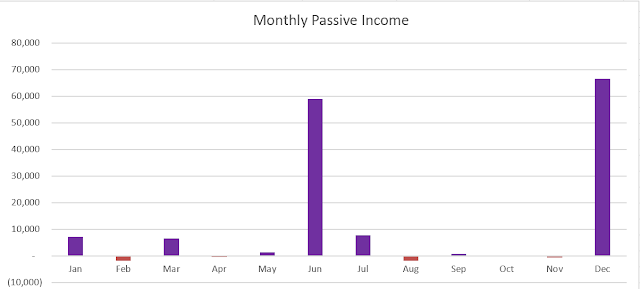

Monthly passive income

With the new bond purchase as well as the new OCBC position, the projected annual dividend / distribution income increased from $134,116 to $144,490 based on the latest forex rates and assuming I fund the purchase with SGD debt.

This translates to around $12,040 per month and how the passive income looks like on a monthly basis.

That's all for the month of August.

Happy retirement planning !

Happy retirement planning !

What is DBS charging for SGD and USD leverage?

ReplyDeleteSGD 2.41%. USD I think more than 3%

ReplyDeletewow

ReplyDeleteGreat post and informative. Really appreciate your views.

ReplyDeleteHow much LTV DBS offers for UBS bond? And what is their fees while buying bond?

Can you please start publishing bond portfolio as you do SRS as that can help people?

Once again thanks for your valuable insight.

I can’t remember exactly how much but you can assume around 50% for investment grade bonds. The bonds market are much deeper. I hope that one day, they can make it more widely available to retail investors. It’s ironic that equity that is more risky can be easily sold but not bonds. 😡

DeleteThanks for the response. Can you please share the list of bonds you have invested to get idea? In US, bonds are available at 2000$ for retails but here hardly anything in SGD space? Do you need to give withholding tax for USD bonds for dividends received?

DeleteThe bond market is very deep but I am quite concentrated in certain bonds. To answer your questions, no withholding tax for USD interest received from the bonds. I will share my bonds portfolio next time. :) not ready to share.

ReplyDelete