SRS Portfolio - 1 May 2020 (Performance since inception)

It is finally May 1st - Labour Day. One more month to go before the CB ends . . . I believe many of us can't wait for the measures to be "toned down".

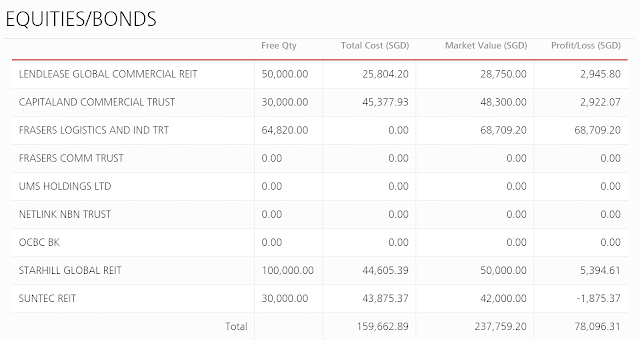

Since my update last week, the SRS portfolio also rebounded alongside the market recovery. The portfolio valuation increased by $21k and one of the major contributor was Suntec REIT which went XD. I didn't time my entry into Suntec Well so it is still carrying a loss.

You can see a more accurate pictorial view of the SRS portfolio below. I have classified the CapitaCommercial Trust as Capitamall Trust ahead of their merger.

Including the cash balance of $61k, the portfolio value is now quite close to the $300k mark.

For those who are new to my blog, i started my SRS account in 2006 and started this blog in 2012. Initially i didn't really track the performance and I always "contribute" to my SRS account around year end in December. Over time, i started to invest more regularly. In order to get a more accurate picture of the performance, i also used the actual dates which i contributed to the SRS account to compute the XIRR.

The purpose of this blog is to encourage you to invest for your future, if you do it slowly over time and you have the perseverance, you can compound wealth over time. As you can see from the table below, i managed to generate an IRR of 6.4%. The performance is nothing to shout about but hopefully i have shown that you can do it slowly over time. You just need to start somewhere.

Happy SRSing. Time to start your journey?

Comments

Post a Comment