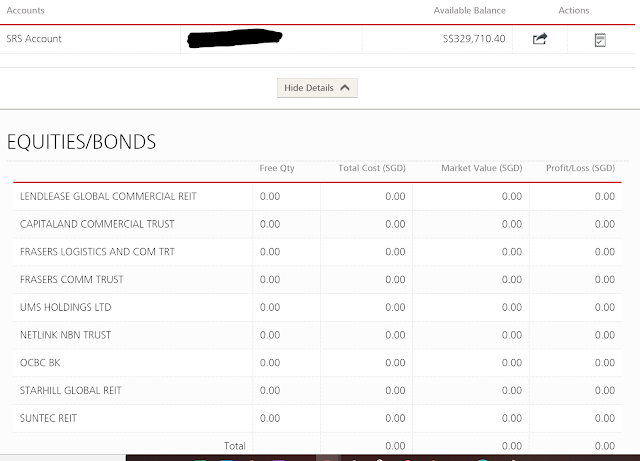

SRS Portfolio - 13 June 2020

I blogged last week that I divested my entire SRS portfolio as the stock market seemed to be running ahead of its fundamentals. The decision seemed to be timely as the market corrected this week and all the counters are currently trading below my selling prices. Whether this turn out to be a brilliant or stupid move - we will know in the next few weeks - as the markets are trying to decide with the bulls and bears fighting it out over the last 2 days. I am staying on the sidelines for now to watch the battle.

As mentioned in my last post, the cash balance now stands at $329,710 and the returns on my SRS portfolio since inception is ROI of 1.67x and IRR of 7.7%.

I will share with readers again when I next construct my portfolio and I will once again target REITs or stocks that are less affected by the longer term implications of Covid-19.

I find the REIT sector here most developed, followed by, surprisingly, manufacturing companies that are exposed to the technology sectors, technology-related companies and perhaps the banks in financial sectors. I will likely avoid pure retail or telco or SGX (industry headwinds), mining, oil & gas, airline and transportation counters or hospitality related REITs or hotels.

Passive income

I mentioned previously that I always look forward to June and December. It is not just because it is the school holidays where I can enjoy some time off - it is also when the bulk of my passive income arrives in my bank account and that helps defray some of the shopping and vacations bills.

The DBS platform helped generate the cashflow profile below for me based on the portfolio of bonds I held through them (I didn't verify its accuracy). Do note that I run a "leveraged" bond portfolio - i.e. i levered up on my bond portfolio to buy even more bonds.

I have built up a decent portfolio of bonds gradually since 2016 and have encouraged you to build up your own portfolio of bonds in the past. However, having said that, the interest rates have been on the decline drastically following the virus outbreak, in tandem with the fall in US treasury bills. While investors are expecting a higher interest rate, those with good credit continue to be well sought after and the risk-reward isn't that attractive.

I will continue to divert the bond interest received inJune into US equities.

Till then have a nice and wet weekend ^_^

your SRS porfolio is impresive. trying to build something like yours.

ReplyDeletelooks like yours is DBS platform? but the higher tier =)

what is the cost of leverage from dbs? (i am considering using leverage to buy into bonds as well, and guessing ~2.5% as the market rate?)

which bonds are you vested in?

I have some local bank SGD corporate bonds and Astrea USD bonds

DeleteHi Chameleon,

ReplyDeleteYes - it is the next tier due to the AUM.

It really depends on which currency you are borrowing. CHF is 0% and Yen is also quite low. USD is now at 1 to 1.2%. CHF, EUR or JPY all at between 0% to 0.75%

thinking perhaps SGD or USD leverage bonds.

ReplyDeleteCHF 0% seems interesting, i guess that means, the yield is also in the ~0.x% range?

do you have a blog post on this ?

Think i blogged about it in this blog before. To borrow at 0% means that the deposits are "negative yielding". So you borrow in CHF and invest in USD but you will be exposed to forex risk.

Deletethumb up!

ReplyDeleteGreat article..hopefully, will have chance to take new positions as market should give opportunity in coming days.

ReplyDeleteI can recall you had UBS Perp bond & BMO perp bond along with Astrea. Have you sold them or still holding it? Can you please share the bonds portfolio as that can help. Thanks..

Still holding on to the UBS perps and Astrea bonds. I recall I didn't manage to get the BMO bonds.

Delete