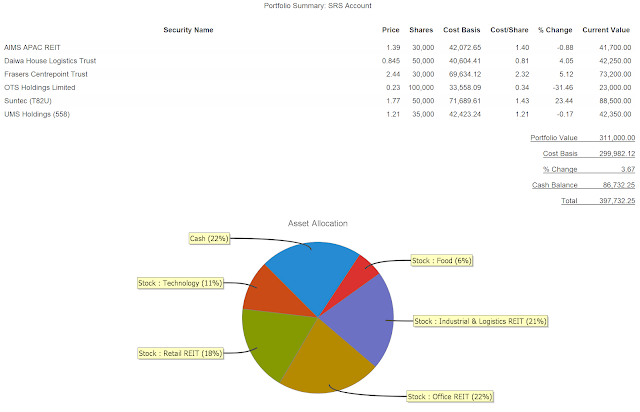

SRS portfolio as of April Fool's Day

The AIMS position which I added in Nov 2021 finally paid the first distribution of $705 to the SRS account in March 2022. The DPU of 2.35 cents was 14.6% higher than the same period last year. Assuming it maintains the same DPU of 2.35 cents per quarter, the passive income will be around $2,820 per year, but I am projecting it to come in higher at $3,000.

The SRS portfolio continued to recover with Suntec leading the "charge" and the portfolio value reached a new high of $397,732. The biggest loser continues to be OTS Holdings, where the bid-ask spread is pretty wide, making it difficult for me to exit this position. I will probably need to exit during periods of earnings announcement (provided it announces some nice set of numbers).

Two April Fool's lessons for readers :

Lesson learnt 🅰- Small caps are probably not suited for my SRS portfolio. I think I am better off sticking to fundamentally strong and dividend paying REITs or stocks. Sentiments probably played a big role in me buying this stock for SRS as I made a good profit from the IPO. 🤕

The other lesson learnt 🅱- Inaction during periods of dislocation (e.g. resulting from the Ukraine and Russian conflict) can be costly. There were a few stocks on my watchlist and the biggest "opportunity cost" todate came from AEM Holdings which I am supposed to "action" when it reaches $4. 🐢

Happy April Fool's Day.... 😆

Comments

Post a Comment