Croesus Retail Trust - Time to say Good "Buy"?

It was an interesting week, where i "received" two privatisation offers - Lafe Corporation and Croesus Retail Trust.

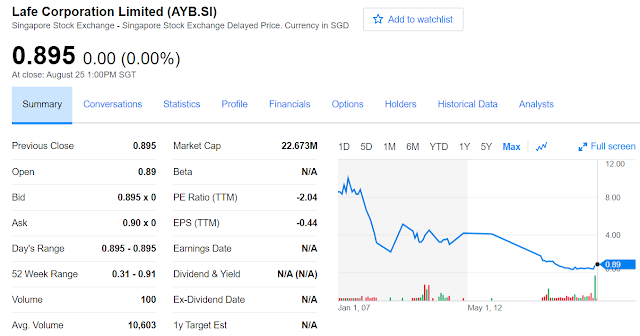

Not all privatisation offers are good and Lafe Corporation was one great wealth destructor

Lafe Corporation was for my dad and listed with much fanfare back in April 2000 with a market cap of $460m. The market cap today was $22m and for every $1 invested in the Company, it is worth only $0.0478 today, destroying wealth for investors in the Company 🤕

While my dad didn't invest from the onset, his few thousand dollars worth of investment a few years back is now worth $36 after share consolidation. Without the share buyback at $0.90, he will be out of pocket by $4 if he had to sell the shares through his broker. Maybe i should send Christopher a "Thank You" letter on behalf of my father? 🙄

Anyway, the morale of the story is to invest in good companies and cut your losses if you are on the wrong boat - which of course is easier said than done! 😁

The same week, i received the scheme document from Croesus Retail Trust ("CRT") as well as a 'non-transferable' invitation to a SIAS - CRT dialogue session (no proxy allowed).

Given my "kachang puteh" holdings, i am likely to give the meeting a miss but in case you don't know, the SIAS-CRT type of dialogues are usually paid for by the Company to SIAS as part of its media engagement plan to "smoothen" the path and allow management to convince shareholders why this is such a great deal for them. In any case, the scheme documents was also written as such. Perhaps they should also invite Blackstone (acquirer) or their investors to the meeting as well? 😂

Let's see what is in the scheme document... i will just focus on the gatefold...

The top right of the scheme document says "your vote counts"... so far still neutral as you can vote "no" to the scheme obviously. The scheme consideration was for S$1.17 in Cash via a scheme of arrangement (not takeover).

Transaction Overview

Funds managed by Blackstone Group is offering to acquire CRT via a scheme of arrangement. If the scheme is approved by Unitholders at the meeting on 13 Sep 2017 10am at the Fullerton Hotel, then Unitholders will receive:

provided that, at least 75% of unitholders who are present or via proxy approve the amendments of Trust Deed and more than 50% in number of Unitholders representing at least 75% in value approve the scheme.... 🤔

In other words, unit holders who hold 25% of CRT will have a big say in whether the scheme goes through or not....

What does the "gatefold" says to Unitholders?

Gatefold are those special paper printed in colour to "highlight" or tell a story in a prospectus or circular and these pages are prime locations in property terms, hence the key messages from the management can be found here. I will paraphrase it here for the semi-hokkien investors... 😁

Story 1 - "Mai Tu Liao (meaning don't wait anymore), this is a good chance for YOU to sell your shares at a si-peh (damn) good price"

They then present graphs to show that $1.17 is the historical high of the stock's trading history since IPO. All factual, so cannot say that they are wrong.

Story 2 - The Buyer is kam-gong (stupid), they are buying your units at si-beh swee (very attractive) valuation even higher than the most bullish analyst hor! Where to find...

They then proceed to you that the $1.17 on offer is higher than the NAV or the adjusted NAV and above the price targets of all analysts covering CRT

Story 3 - Ma kong bo (don't say I never tell you)... if you leeject (reject) the offer, next time bery bery difficult for you to run road...

This is the most absurb ah... lim-peh is only a small fry... still enough volume to run road lah... plus i have been holding it for the dividends, not to trade in an out leh...

Story 4 - Even the most kiang (clever) adviser also tell you the buyer is gong (stupid), so please take the money and run !!

Like that win liao... everyone says the buyer is gong.... so who is this gong buyer?

Errr... even though i beng but i not blur leh... i know what is a Black Stone hor... Black Stone is is "or giao tao" in Hokkien hor!! Is the Blackstone Group so gong or not... let me go and see if can dig out some track record of Blackstone Funds....

Not bad leh... I assume the Blackstone Real Estate Partners Asia fund (2013 vintage) will be buying this and as of 30 Sep 2016, the net multiple and IRR is 1.32x and 16.9% leh.......Ok the buyer is not as gong even though everyone seem to tell me they gong... they are actually going to make more money after i sold this investment to them...

Who can actually "de-rail" the scheme?

Given the huge free float, how the voting will happen will actually be quite interesting! In addition, a Swing Voter - Goh Yew Lin also raised its stake in the Company to 7.11%. The article is here. It will be interesting to see how he votes and whether he will find a few kakis to vote against the scheme.

My View

Given the free float of 79.8%, it will actually not be easy to delist the company via a public tender or take-over, which is why the buyer is buying this through a "all or nothing" scheme of arrangement. In addition, if not for the offer from Blackstone, the share price would probably take a much longer time to hit the current levels. So if Blackstone is able to find value at $1.17, it's natural that they will want to take it private completely so that they can do their own asset enhancements.

What is the yield at $1.17. Assuming the distributions is maintained at 4 cents (for discussion sake), the yield is still a decent 6.8%. If the acquirer takes a leveraged position through cheap financing, the yield can be in the teens....

I have yet to decide whether to vote for or against or whether to attend the SIAS-CRT or the actual meeting... i think it can be an interesting learning experience! 😎

Is it time to say Good Buy or Good Bye? You tell me... vote here.

Comments

Post a Comment