Applying for T-Bills online through DBS

You can now apply for T-bills online, kudos to DBS, who finally made it seamless for investors. No more going down to the branch to queue up! Time is money!

|

| Source: CPF |

Let me share my experience. After you logged into your DBS online account, mouse over "Invest" and select "Singapore Government Securities".

Thereafter, select T-Bills and click Next

Select the only T-bill that is available at this moment and click Next

Select CPF-OA and thereafter, fill in the details.

Then key in the details of how much you want to apply using CPF-OA, including whether you want to put in a competitive bid or not. Putting a competitive bid is just to prevent a "freak incident" like a $5,000 COE? 😅

My own gut feel is the rate this time should range between 3.8% to 4%, so if you are happy with 3.8%, you can be brave and select "Non-Competitive Bid".

Having said that, I selected a "competitive bid of 3.5% and keyed in $528,000 for good luck. 😸 The rule of thumb is to keep a balance of $20,000 in the CPF balance as the first $20k in the OA and the $40k in SA earns an extra 1%. See link here.

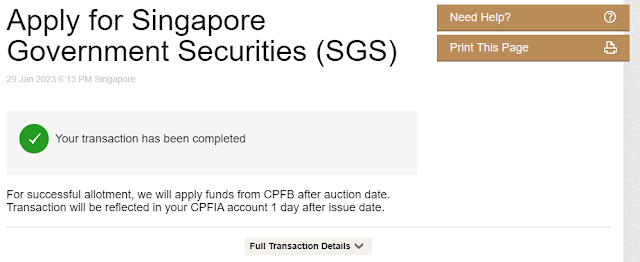

Once you are have successfully applied for the T-bills, you will receive an acknowledgement form. It is quite comforting to know that the funds will be deducted only on successful allotment, meaning that I will only lose one month of interest for the funds that were successfully allotted.

Took me less than 5 minutes from start to end. The hardest part was deciding on whether to put in a competitive bid or not.

Happy T-billing!

Comments

Post a Comment