Goal No. 7 (Rental Income) + SRS Portfolio

Goal No. 7 was many years in the making.

It started with de-coupling, which I tried to do pre-Covid and only managed to do so in Feb 2022.

I managed to secure a rental property in August 2022 (See pictures here) and took over the keys only in October 2022. The renovation took 2 more months and the unit was put into the market only in Jan 2023 (as stated in my goal no. 7). It took me more than 3 months to finally secure a tenant and no prize for guessing the nationality - Ah Tiong.

It was really not funny because many of the potential tenants were S-Pass holders and the monthly rental I am seeking is way above their purportedly monthly salary. On a deeper probe, you know they don't really work for the companies that sponsored their S passes. One was a driver for a tycoon, one worked as a singer and the other a dancer in nightclubs (you know what I mean) 挂羊头卖狗肉. From this experience, I know there are many illegal S-Pass holders moonlighting fulltime and many companies are openly flouting the rules to earn extra income by "renting out" their S Pass permits.

Evenutally I got a tenant working at a tech firm where a Zaddy CEO was grilled by US congress recently. Ironically, the net yield is still lower than puting the cash in T-bills. 😆

Net yield = (Yearly rental less annual maintenance less property tax) divided by (Cost of property plus renovations) = 3.33%. I haven't even factor in the agent commission, the potential problems dealing with tenants and the assocated tax on rental income. Probably better off investing in REITs that is tax-free.

The only "beauty" from rental income is (1) I am holding hard assets and (2) I get a consistent monthly cash flow that is less lumpy and the idea is that next time, I can AirBnB around the world, probably arbitraging if I choose to live in a country with lower cost of living. This is the long term plan to prepare for our retirement.

IRAS - Income from property rented out

For my own benefit, I am writing this down what is on IRAS website for my future use when I submit the tax for FY2024.

Rental income is the the full amount of rent when due from tenant (not based on actual date of receipt).

Deductible expenses - Property owners who lease their residential properties can now enjoy the convience of "pre-filled" rental expenses that can be deducted from the rental income. This is based on 15% of gross rent. In addition, owners can claim mortgage interest on the loan taken to purchase the tenanted property. The advantage of using this is no longer necessary to keep records of the other rental expenses incurred.

Alternatively, property owners can cop to claim the amount of actual rental expenses incurred but would need to retain all supporting documents such as tenancy agreements, bank morgtages, invoices and receipts for at least 5 years. Deductible expenses include loan interest, property tax, fire insurance premium, maintenance fee, brokers' commission paid.

It is important to note that any expenditure incurred by a landlord for the repair, insurance, maintenance and upkeep of a property when it is vacant in any part of a basis period can be deducted against rental income - in other words, I can still claim the property tax and maintenance paid while looking for the tenant. Heng ah, means the 4 months I took from Jan this year is deductible.

Looking at my own calculation, the delta in the taxable income between storing the receipts versus pre-filled is around $8,001 for FY2024 (this year) as under the pre-filled, I am unable to claim the 4.5 months of 'empty house'.

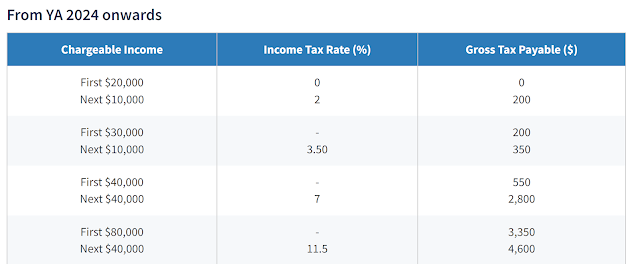

Since wifey is not working, the tax to be paid is $200 as the net rental income is less than $30,000 but under the pre-filled, the tax payable is $389. In other words, effort to keep all the invoices and receipts is worth $189. Having said that, it wiill increase in FY2025 when the full year of rental is included.

Note to self - Don't use the pre-filled and keep all the relevant receipts online for the FY2024 tax filing.

SRS Portfolio as of 7 April 2023

The portfolio value of SRS continued to recover over the last week, despite weakness in the US markets. Nothing to report on the portfolio at this juncture.

Happy SRSing!

Comments

Post a Comment