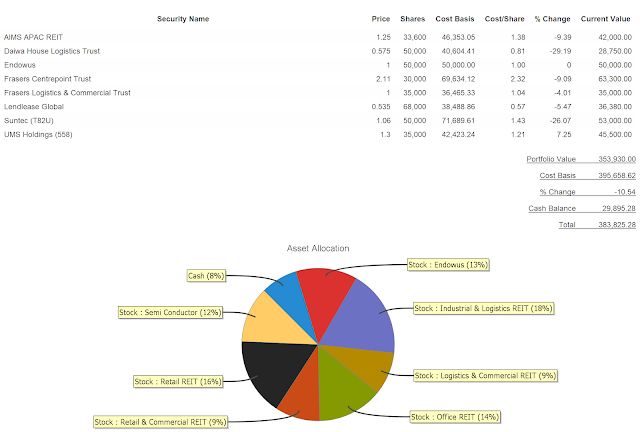

SRS Portfolio Yield of 5.9%

My SRS portfolio construct is almost complete and the "missing" counters are probably the banks at this juncture.

Assuming an interest rate of 3.5% on the money market funds parked in Endowus, the cash distribution on this portfolio based on last year's distribution rate is $23,377 or 5.9% based on the portfolio cost (not current NAV). Based on the payment dates, the SRS portfolio will churn out some money every month except for April and September (also called the eat grass months).

Global Portfolio

Things seemed to be looking up for the US portfolio even though I have been waiting for lower prices to accumulate more. At one point, every counter is negative except one and as of today, everything counter is in the green except one. A very short "correction' window. I added one small position in Meta Platforms (or previously known as Face Book) on April 29.

As a reminder, the Global Portfolio is for me to accumulate stocks that I like over time and for the long term. I am investing in the business and not the price, hence I don't share the profit and loss on those positions as it is a distraction.

Happy SRSing.

Comments

Post a Comment