SRS Portfolio - 30 June 2019

How time flies and we are now 6 months into 2019 . . . let's do a quick update on my journey to financial ... "debt".

Now that I have built up a substantial bond portfolio as my foundation over the last 3 years, the next step would be to focus on building a portfolio of stocks. My ideal stock portfolio would comprise dividend paying stocks and REITs on SGX as well global blue chip stocks listed in US.

I would need to be disciplined to execute on this strategy.

I have blogged about building a bond ladder a few years back in 2016. In my last post, I also shared with you my intention to draw down on the home equity to complete our bond portfolio.

Well, I have acted upon the plan and the "result" is below. Here is the step by step guide for those who are interested.

Step 1 - Draw down the excess home equity as new mortgage loan. The amount you can draw down will depend on how much you have paid down the mortgage and whether the property has increased in market value over time. In my case, i have been fortunate on that front. The home loan is probably one of the "cheapest" financing you can get at around 2.2%.

Step 2 - Open a private banking account with a local bank. I probably can't qualify for a "foreign bank" like UBS or Credit Suisse , so I decided to open an account with our local bank DBS Treasures. I quite like the app and the fact that I can do transactions online and consolidate all portfolio in one place.

The perks include using the lounge at the airport when you travel and enjoying a "free" pick up service home when you return. It is frankly not very useful to me since I travel mostly on business and have access to the Krisflyer lounge and i can claim for "grab" fares anyway.

Step 3 - Deposit the cash drawn from the home mortgage and savings and can get a credit line. The ratio is usually two is to one, meaning if you deposit $2m, you can get a credit line of another $1m or more.

The credit line allows me to enjoy a levered return on my portfolio. I can borrow in different currencies. If you are comfortable with the foreign currency rates movement, It is pretty attractive to borrow in EUR or JPY as the borrowing cost is only 0.75% compared to 2-4% if you borrow in SGD or USD.

Step 4 - Start investing and build up your bond portfolio!

My timing couldn't have been better as it coincided with Astrea V and it is a credit which i am very comfortable with. I managed to build up a portfolio of investment grade bonds across the different tranches.

Assuming I can sell the bonds portfolio and return all the borrowings when I turn 62, it would allow me time to compound the interest income over the next 15 years. The key assumption is that there must be zero bond default, hence I only go for high quality, investment grade bonds.

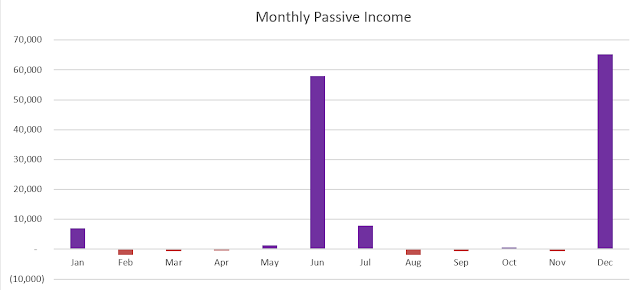

Monthly passive income

The levered yield on my bonds and stock portfolio currently stands at 14.9%. I am pleasantly surprised at the high levered return from my bonds portfolio as i am able to borrow quite cheaply against the bonds.

As a result of the above, my passive income jumped significantly from $81,750 in April to $134,116 and that translate into more than $10,000 per month. Do note that this is financed by "debt" where instead of fully paying off my mortgage, i have decided to borrow more instead.

As a result of the above, my passive income jumped significantly from $81,750 in April to $134,116 and that translate into more than $10,000 per month. Do note that this is financed by "debt" where instead of fully paying off my mortgage, i have decided to borrow more instead.

What's next ?

Now that I have built up a substantial bond portfolio as my foundation over the last 3 years, the next step would be to focus on building a portfolio of stocks. My ideal stock portfolio would comprise dividend paying stocks and REITs on SGX as well global blue chip stocks listed in US.

I would need to be disciplined to execute on this strategy.

SRS Portfolio @ 30 June 2019

The SRS portfolio continue to do well as of 30 June 2019.

In May, I bought Suntec REIT at $1.80 due to weak sentiments caused by its share placement. Readers who read about it could actually have acted on it as it fell to $1.78 immediately after my post. 🤣

In line with the run up in other REITs, it has since recovered to a high of $1.95. Since I have received a year's worth of "distribution income" in one month, I have decided to say "thank you" at $1.94 on Friday. The sale will generate around $3,800 to my SRS Portfolio.

Another REIT in my SRS Portfolio - Frasers Commercial Trust, also performed very well. It hit a new high of $1.68 following the announcement that Google has signed a long term lease at the Alexandra site. The unrealised profit now stands at $25,000

On the whole, the SRS Portfolio is stable and post the Suntec divestment, I have around $113,800 to be deployed. Let's see if market opportunities would present itself if the trade talk between US and China fails.

Conclusion

I have shared with you my levered return bond strategy using a combination of cheap home mortgage (all in cost at 2.2%) and foreign currency loans (all in cost at 0.75%). The levered return is in excess of 10%. However, this strategy is only suitable for investors who don't mind the forex exposure as well as use of leverage. It's definitely not for everyone but I am sharing so that you aware of the different options available to you. There is no one size fit all, pick a route that suits your personality and skill sets.

That is all for a lazy Sunday afternoon. Enjoy your journey to financial freedom ! 😉

hi, i think yours is DBS treasures private? not the normal DBS treasures.

ReplyDeletecoz yours have airport lounge. normal Treasures dont have access..

Haha yah.

DeleteHi Mr ipo, I am a big fan of you,I am very impressed with your investing strategy. May I know what are bonds you have invested? And how you invest?

ReplyDeleteI invested in the Astrea series of investment grade bonds. You can only use this strategy with investment grade bonds that have very very very very Low default risks.

DeleteMay you describe more on the credit line and how can we get the Japan or Euro loan? i try to find a lower interest loan but it seems all at least 7% and above.

DeleteYou can find more info here. https://www.dbs.com.sg/treasures/investments/product-suite/investment-financing/mrtl

ReplyDeleteHi Mr IPO, what is the spread (if any) that was applied to you when you take up financing under the MRTL facility? Is your rate based on spread + interest rate of that particular currency?

ReplyDeleteIt is base rate + spread of the underlying currency. For example base rate of borrowing in JPY is zero and the spread is 55 bps. The base rates for a lot of currencies are zero now.

Delete