SRS portfolio - Election 🗳 Trades ?

Election is here and this time round, the atmosphere is so dead without the rally and of course it's missing the feisty 花姐 💐 and fearless Teochew uncle. I wish "happy retirement" to the both of them and if I am in the mood, I will share my thoughts on the election in a separate post ... 😴

Election trades

Readers know that I sold all my shares in early June and have been patiently waiting for the share prices to correct.

Some of them have corrected to support levels and valuations which I am comfortable with and it has been a busy 3-day buying spree for me.

SRS account

I bought the following positions for SRS account. As the positions have not been reflected in my SRS account, I will summarise them below:

- 1 July - 2,500 UOB at $20.58

- 2 July - 35,000 Suntec at $1.44

- 3 July - 100,000 Starhill at 53c

I still have $174k cash in SRS to be deployed.

Non-SRS account

The non SRS trades are also shared this time round just to share with readers how I position trade. The first criteria is that the stocks I trade are fundamentally sound. I don't usually trade penny stocks as a matter of philosophy as I have seen many sad stories of people who do that.

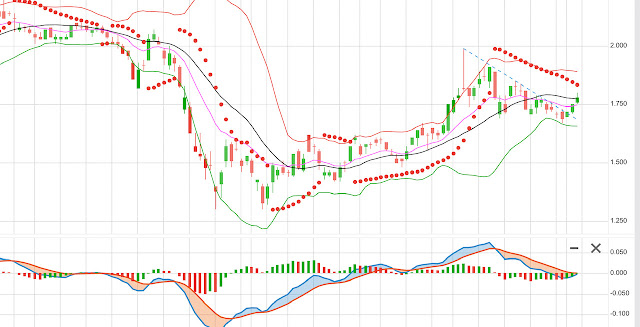

The above chart is CapitaCommercial Trust. I don't use many indicators - primarily candlesticks, parabolic, MACD histogram and trend lines (supports and resistance).

I use only one example here because the charts look about the same for each stock:

- The price broke the down-sloping trend line

- The price rebounded off a support level

- MACD sloping upwards

I am happy to hold on to the stocks if the trades didn't work out as they are fundamentally sound and I can collect some dividends along the way. While this philosophy has changed over time, I also won't hesitate to cut the positions if the need arises.

Trades done are summarised in the picture below:

The trades were made over the last 3 days.

- 1 July - 2,000 DBS at 20.25

- 2 July - 30,000 CapitaMall at $2.02

- 2 July - 30,000 CapitaComm at $1.72

- 3 July - 45,000 Mapletree North Asia at $0.95

May the best stocks win !

That's all for the final election weekend. I am positioning these trades for a pre and post election rally!

May the best stocks candidates for Singapore 🇸🇬 win the election 🗳!

Thanks for the sharing, am curious to know when you choose to use your SRS account to buy versus non SRS? Since its all SG equities

ReplyDeleteGood observation :) SRS account usually for boring, slower moving and income oriented Stocks and for longer term hold. This time round, there wasn’t really any distinguishing factor other than whether I feel like calling my broker or DIY.

Delete