SRS Portfolio 30 June 2024 + Biden Trumped

I travelled to the United States a few times a year over the last decade and I have observed how the cities in the US deteriorated. The petty crimes had gone up, drug addicts were roaming the streets in San Francisco and homeless openly peeing on the streets in New York . On the positive side, I have also seen some infrastructure improved. Los Angeles Airport is not as bad now and they have added new buildings and rail lines in New York city.

Even before last week's presidential debate, my money had been on Trump to win the elections in November. The debate on Thursday further validated my views. While I am not a fan of Trump, the US under Biden hasn't been great either and unfortunately his health can no longer handle the stress of this job. I am appalled that a big super power like the US cannot produce better candidates?!?! Seriously, the whole political system in the US is flawed and the society is divided and the US is definitely on a long term structural decline.

Will Democrats panic and force Biden to step down? In my mind, unlikely and too late to do so. So Trump it is unless they can convict him before the presidential election.

SRS Portfolio - 30 June 2024

Time flies and we are now in the first half of 2024. The SRS portfolio is almost fully invested and the cash is around $78,192 (including MMF in Endowus). The only corporate action is a distribution of $796 from AIMS APAC REIT since my last update. There is no major news or updates to the SRS Portfolio.

Passive Income

One of the biggest allocations to the bond portfolio was Astrea V, which was recently redeemed and consequently, my projected passive income for 2024 will drop significantly this year unless I add new fixed income positions. In looking for bonds, credit quality is of utmost importance and I can accept a lower return in exchange for better credit quality. The key reason why I like the Astrea bonds is the higher yield and higher ratings when I compare them to the unrated local corporate bonds. Perhaps it is time to consider the secondary market for loading up on the Astrea bonds unless there is a new Astrea bond issuance. It might be a good time to lock in the interest rates if the US finally cuts its fed rate.

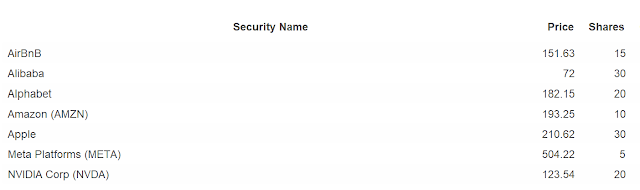

Global Portfolio

No change to my Global Portfolio. I am taking a passive approach on this. Interestingly, the SP 500 ETF is showing some signs of weakness after a massive 8-months bull run that started from Nov 2023. Let's see this is the start of a healthy correction for the US markets.

That is all for a lazy and rainy Sunday afternoon. Hope you had a good rest and get ready for some volatilities in the second half of the year! With the UK, France and US having elections, the world may turn topsy turvy . . . 🤕 😵💫

Comments

Post a Comment